Mergers & Acquisitions

Let's Start A ConversationAbout to take the M & A playing field? Consider us your CFO’s MVP.

WHAT THE PROS KNOW:

The greater your bench strength, the better your odds of deal success.

And that’s where we come in. Our financial leaders can strategically guide you through the merger and acquisitions (M & A) process play by play, from initial planning to close and on to final integration. Serving as an extension of your executive team and second quarterback to your CFO, we’ll help you get your deal across the goal line.

M&A WINNING PLAYS

- More than $440 million in M&A deals

- 20 years of successful M&A experience

- Consistently help clients achieve premium multiples

- Experienced with fast moving “high velocity” deals

- Utility player with the ability to sub-in and help out all team members

Our winning playbook is based on

TRANSACTION PROCESS LEADERSHIP.

It’s our job to see downfield, anticipate and avoid problems, and seize opportunities to clinch the winning deal.

WE KEEP BUYER CONFIDENCE HIGH

Deals are delicate and timely. Positioning deals for success is an art. We help companies deliver pivotal information at the right time so buyers remain confident about the deal.

WE SERVE AS AN EXTENSION OF YOUR EXECUTIVE TEAM

Unlike other mergers and acquisitions players that exist only on the peripheral field, we are an embedded member of the seller’s executive team.

WE PREVENT COSTLY DISTRACTIONS

Taking an eye off the ball of day-to-day business often leads to financial deterioration that can kill a deal. We enable CEO and CFO’s to focus on daily operations and results that drive value.

WE IMPROVE DEAL QUALITY

We understand what buyers care most about and that’s where we focus our resources, positioning critical information in a compelling way.

WE PREVENT DEAL FATIGUE

Deals are intense and complex, which can lead to exhaustion. We bring the backup that powers companies through to the finish line.

WE INCREASE VELOCITY

Strategic buyers tend to move fast. Being swift and keeping pace requires laser focus to ensure that all of the details are in sync.

The M & A Playing Field

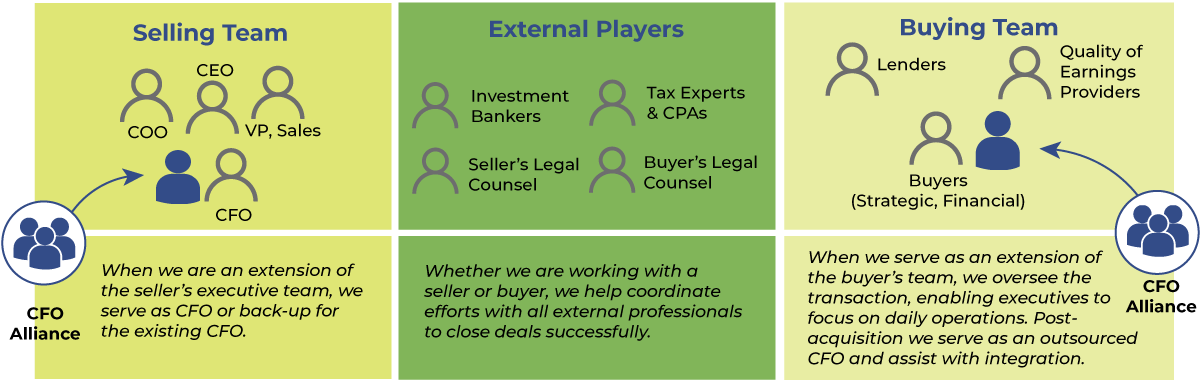

One reason merger and acquisition deals are so complex is the number of players involved. In addition to the buyer and seller, there are numerous external players that are essential to closing a successful deal. Our goal is to help everyone win, from sellers, buyers, legal counsel, investors and more.

CFO Alliance provides transaction process leadership for sellers, improving deal success for all Merger & Acquisition players.

In the same way we keep deals in motion for sellers and buyers, we bring that forward momentum to all members of the M & A ecosystem. We help deliver valuable, accurate, and complete data that is needed to keep transactions on track. We go to work, improving upon seller strengths and fixing problem areas. We know what it takes to keep deals out of the red zone and across the goal line.

CASE STUDY

Winning the M & A Game

CFO Alliance keeps deals out of the red zone to cross the goal line.

When Tribridge needed a partner to help propel them through the M & A process, CFO Alliance provided the support needed to successfully close the deal.