Why You Still Need a 13-Week Cash Flow Strategy

During Periods of Growth

It’s a stairway to success

- Cash flow is King

- Growth is rarely straight forward

- Investors care about cashflow

- Revenue dosen’t equal profit

The market is flush with cash right now, and many businesses are growing rapidly. It’s a great time for founders to catch the attention of private equity companies looking for high-yield investments and to use that extra capital for aggressive growth projects. In conditions like these, it’s easy to get laser-focused on top-line revenue without taking long-term cash flow projections into consideration.

The problem is that we’re also seeing skyrocketing costs across the entire supply chain, from talent to raw materials to manufacturing to delivery. Everything costs more right now, and that’s assuming you can keep your supply chain stable and find enough people to fill your open roles.

In other words, not staying disciplined with cash could spell serious trouble – even if you’re growing.

Why Cash Flow Is King

Private equity companies are extremely pragmatic about cash. They understand that cash is their most strategic asset, both in times of growth and during periods of uncertainty. On the flip side, PE firms do not respond well to unexpected cash surprises and fire drills, especially if it means they have to put more money into the business. Most founders can relate to this since cash surprises send your business into a tailspin too. The stakes are even higher when you are answerable to investors. If you want to impress them, you’ll need to become a cash flow connoisseur.

But why? Why is a 13-week cash flow plan so important if you have tons of revenue and an influx of investment capital to work with?

Growth is rarely straightforward

It tends to be messy and unpredictable, with plenty of risks as well as opportunities. Growing often means reassessing talent costs and needs, adjusting back-office processes, or overhauling your financial strategy. All of this translates into spending more as you scale. If you aren’t keeping a close eye on cash flow, it’s easy to end up in a financial hole you can’t get out of.

Working Capital

The old saying “You have to spend money to make money” may be a cliché, but that doesn’t make it any less true. As you expand, you will experience fluctuations in the amount of working capital you have available. For example, you might see increases in payroll, inventory, and supply chain expenditures which will have to be paid before you can charge your customers. In times of growth, these cash outflows can drain your bank balance to a dangerously low point if not managed properly with a 13-week cash forecast.

Investors care about cash flow

Private equity firms won’t stand for muddy financials. They will want to see projected cash flow not only for today, but also six, ten, and thirteen weeks out. They will also want to take a close look at budgets, revenue cycles, and other key financial reports. If you can’t show them the money, you’ll lose your opportunity to secure the investment.

Revenue doesn’t equal profit (or cash)

When you only look at revenue, you don’t get a clear picture of your company’s true financial performance. As you grow, you’ll spend more on labor, supply, production, and other outflows that impact your bottom line. Sometimes you have peaks and valleys with your cash, and sometimes you might see negative numbers. Even if your company is wildly profitable, problems will occur if you can’t collect cash from customers in time to pay your suppliers. That’s why it’s essential to look at the whole picture, not just what is coming in.

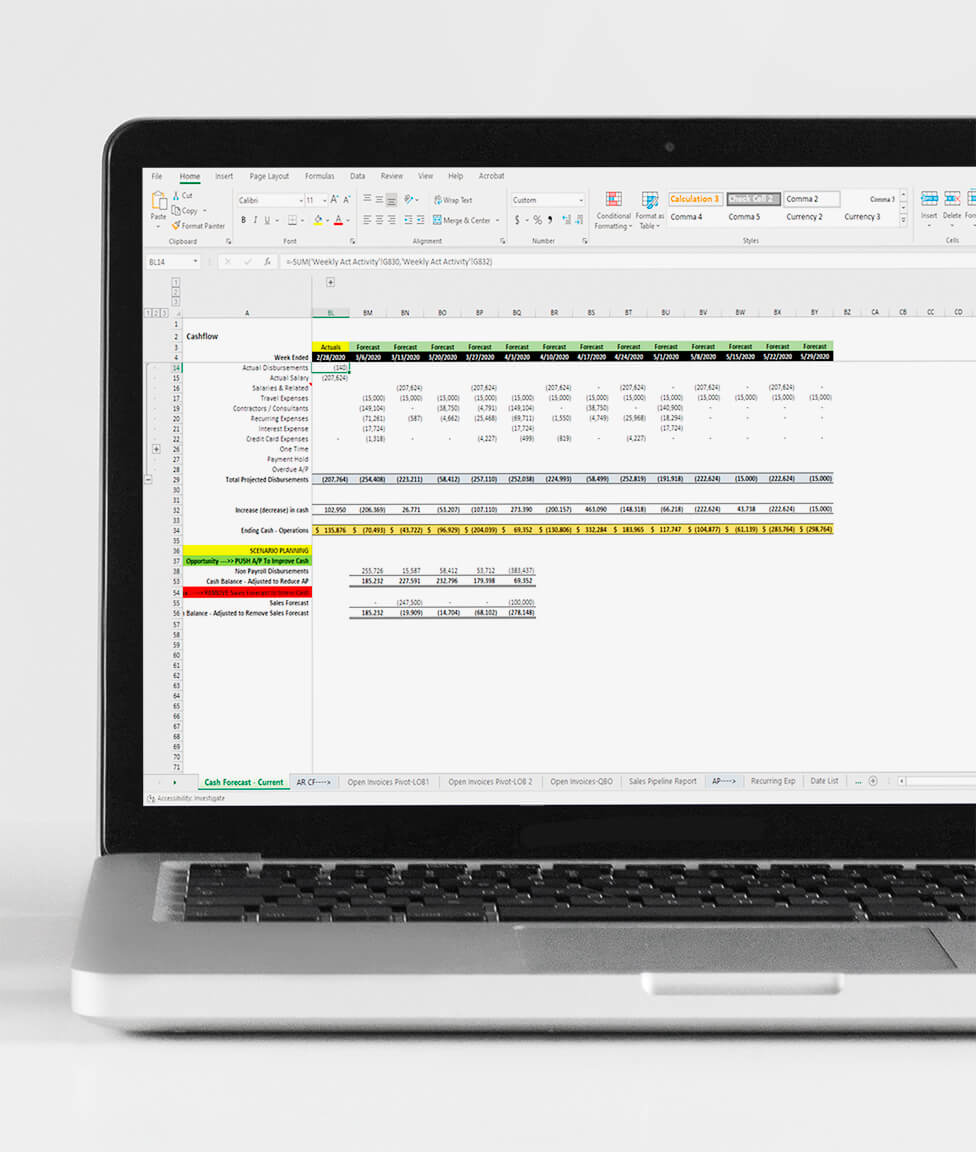

A 13-week cash flow strategy converts uncertainty into clarity so you can navigate your business based on reliable data. You might not like what you see three or four weeks out, but you have the information you need to make course corrections before minor cash flow issues snowball into devastating disasters.

How a 13-Week Cash Flow Strategy

Supports Sustainable Growth

Periods of growth are complex and require more discipline and more sophistication as you establish sustainable financial strategies that will yield high returns. If you are aiming to raise capital through private equity investment, you’ll need to show investors that your business is financially stable. If you have already received an influx of cash from private equity investment, you still need to be disciplined with cash flow so that you maintain trust with investors and stakeholders.

A 13-week cash flow strategy takes the guesswork and gut feeling out of financial decisions by supporting:

- Enhanced Visibility – Your cash flow strategy gives you reliable, actionable data you can depend on to make good decisions. It clears up those muddy financial waters so you aren’t trying to navigate blindly. Even when market conditions change, supply and labor costs fluctuate, or a global pandemic wreaks havoc on your business, clear cash flow projections will help you keep a steady hand on the helm.

- Better Decision-Making – When you know what’s happening with cash flow, you can make better decisions about where to allocate your resources. You’ll be able to project what’s happening far enough in advance to move forward confidently or to cut back if necessary.

- Rapid Agility – Good data makes it possible to see when danger is coming so you can make necessary course corrections. You might not like what you see six weeks out, but you have time to consider cutbacks or reallocations of cash to solve the problem.

- Investor Confidence – Having a clear financial strategy positions you to secure investment capital so you can continue your growth trajectory. It also enables you to maintain trust with investors and critical stakeholders once you close the deal.

Growth is not a uniform process where you continue growing at a stable, predictable pace with cash flow all lined up neatly from start to finish. Growth is messy. Sometimes it’s painful. Sometimes you see exciting revenue surges or get an influx of investment capital, only to discover that production costs or labor shortages have disrupted your budget.

When you experience rapid growth in an uncharacteristic market (like the one we’re seeing now), your cash flow strategy will enable you to put that exciting new revenue to work in sustainable ways that support long-term growth.

If you need help getting started, we’ve got your back! At CFO Alliance, we believe a 13-week cash flow is the most important tool in your growth arsenal.

Give us a call today and learn how to take your next step toward a stronger financial future.

Related Post

4 Strategic Imperatives to Unlock Sustainable Revenue Growth

4 Strategic Imperatives to Unlock Sustainable Revenue GrowthCreating long-term, sustainable revenue growth takes more...

Future-Proof Your Workforce with a Modern Talent Agenda

Future-Proof Your Workforce with a Modern Talent AgendaWhat does the future of talent look like? It’s a fair question,...

The Talent Behind the Tech: How Skills-Based Hiring Supports Technology Innovation

The Talent Behind the Tech: How Skills-Based Hiring Supports Technology InnovationStaying relevant with technology in...