How To Build A Strong Balance Sheet: Definition & Examples

What does it take to have a strong balance sheet? That’s a great question, and it’s a little murky for many founders. If that’s you, we’ve got your back. Strong balance sheets and healthy assets are built on healthy financial habits, so get ready to flex your financial muscles with these balance sheet basics.

What Exactly is a Balance Sheet?

Before we get too deep into how-to’s and healthy habits, let’s start by demystifying the balance sheet as a concept. You probably have a general idea of what the balance sheet is for, but maybe you’re a little foggy on why it is important or what it should look like.

Think of it this way: a strong balance sheet shows you where your company stands financially at any given point in time. It is one of the most important financial statements you need to ensure the financial health of the company.

Successful companies use the information in the balance sheet to manage cash flow and working capital. With this data, they can continue to grow and even invest during periods of recession. They aren’t crippled when revenue drops, because they have plenty of cash on hand to cover their liabilities and to take advantage of lower prices during a recession.

It’s the same strategy the John. D. Rockefeller used to build his empire: strategic focus and careful management of assets and risks so he could act decisively when opportunities arose.

And it can work for you too.

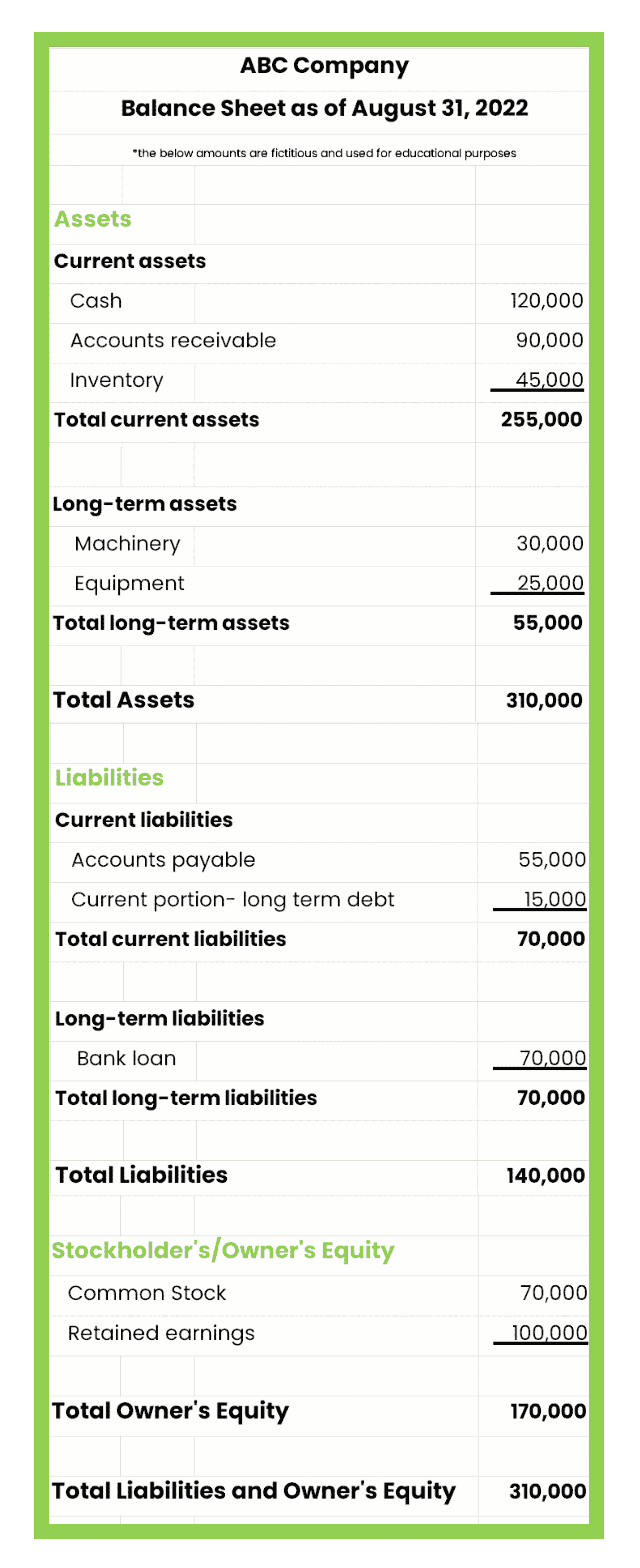

A Balance Sheet Example

A balance sheet should show you all the assets acquired since the company was born, as well as all the liabilities. It is based on a double-entry accounting system, which ensures that equals the sum of liabilities and equity. In a healthy company, assets will be larger than liabilities, and you will have equity. Here’s an example:

How Do You Build A Strong Balance Sheet?

Success in any endeavor requires discipline. If you want to have six-pack abs and biceps like Chris Hemsworth, you eat your Wheaties and go to the gym. If you want to have healthy financial assets, you develop a strong balance sheet. Here’s how:

Understand Balance Sheet Vs. Income Statement

The balance sheet and the income statement work together hand-in-hand, linked by the equity section. Whatever income you generate is carried over to the balance sheet and reflected in equity. The difference is that the income statement shows revenue and expenses that equate to profit and loss of the business over time, while the balance sheet shows the overall financial position of the business in terms of assets and liabilities.

Get to Know Your Balance Sheet – If you have never done much with your balance sheet, spend some quality time getting to know what it includes and how it functions. A few key ratios that will provide insight into the health of your balance sheet are:

- Working Capital – Calculate working capital by subtracting current liabilities from current assets. This number shows you how much you have on hand to pay bills and manage day-to-day expenses of the business.

- Debt to Equity Ratio – Use this ratio to determine whether you have an appropriate amount of debt: not too much and not too little. A high debt-to-equity ratio is considered risky and may indicate that you are relying too heavily on debt to grow your business.

- Fixed-Charge Coverage Ratio – This ratio measures EBITDA (minus capital expenses and taxes) against fixed charges such as interest and lease payments. A higher number corresponds with less financial risk. If this ratio is too low, you may not have enough capital to meet regular financial obligations.

Zoom In On Specifics – As you saw in the example, a balance sheet is comprised of three categories of data:

-

- Assets – Assets include receivables, cash, inventory, investments, and other things that hold economic value. Having healthy assets means that your receivables are current, you have the right amount of cash (and a 13-week cash flow strategy to stay on track), your inventory is sustainable and meeting demand, and you have sufficient working capital.

- Liabilities – Liabilities include any debt associated with the business. This may include loans, accounts payable, mortgages, and expenses.

- Equity – When you subtract liabilities from assets, you get equity. This number shows the value inherent in the business for the owner and shareholders.

- Don’t Ignore It!– Many founders are intimidated by their balance sheet, so they don’t pay much attention to it. But that can land you in serious financial trouble if you have insufficient working capital to handle unexpected changes. If you feel intimidated by the idea of managing your balance sheet, reach out for help. Whatever you do, don’t ignore it!

What Does It All Mean?

Having a strong balance sheet means that you have ample cash, healthy assets, and an appropriate amount of debt. If all of these things are true, then you will have the resources you need to remain financially stable in any economy and to take advantage of opportunities that arise.

If you’re not there yet, we can help! At CFO Alliance, we work with founders every day to build strong financial systems and processes that position companies for financial success. Contact us to see how we can help you build financial confidence and grow!

4 Strategic Imperatives to Unlock Sustainable Revenue Growth

4 Strategic Imperatives to Unlock Sustainable Revenue GrowthCreating long-term, sustainable revenue growth takes more...

Future-Proof Your Workforce with a Modern Talent Agenda

Future-Proof Your Workforce with a Modern Talent AgendaWhat does the future of talent look like? It’s a fair question,...

The Talent Behind the Tech: How Skills-Based Hiring Supports Technology Innovation

The Talent Behind the Tech: How Skills-Based Hiring Supports Technology InnovationStaying relevant with technology in...